In the early 2010s, our wind business slowed down and forced us to find new applications for our permanent magnet (PM) technology. We gravitated to marine power generation and propulsion – the mechanical rotating speeds are relatively slow, which enables PM machines to excel.

The focus was on direct-drive shaft generator systems, an area which has long been dominated by conventional electrically excited synchronous machines – known for their significant downsides. The key thing with shaft generators, where the generator is integrated into the propeller shaft, is that the electric power is generated with a vessel’s 2-stroke main engine, which burns much less fuel than conventional gensets driven by 4-stroke diesel engines.

In early 2015, we delivered the first shaft generators, loosely based on our PMR 1000 wind generator, to WE Tech, a solution provider for Post-Panamax-sized carriers. Soon, WE Tech ordered more. And in the next couple of years, we delivered nearly 35 PM shaft generators. However, in 2017, business slowed down significantly. The primary reason was the drop in oil prices from approximately $120 per barrel in 2014 to less than $40 per barrel in 2016. With the main selling point for using shaft generators instead of conventional gensets being fuel savings, the situation negated even our best payback calculations.

The whole world is now moving toward cleaner energy production and zero-emission power sources. Wind and solar power are rapidly replacing conventional fossil-based sources. In Finland, for example, the share of wind power in total electric power production was over 10% in 2020. And that number is growing quickly. In addition to zero-emission energy production, less-polluting fuels, such as liquefied natural gas (LNG), are also replacing the dirtiest ones, such as oil and coal. This has caused a huge boom in building LNG tankers, especially in South Korea, which represents almost a 90% share of the total LNG newbuilds.

An LNG tanker is a vessel carrying natural gas from offshore gas fields to land terminals, and the most cost-effective way to do this is to cool the gas down to -162 °C. This is the point where the gas turns to liquid, and its volume drops to 1/600th of what it was, making its transportation cost effective. These vessels then carry this liquid to land-based gas terminals, where it is “regasified” before feeding into gas pipelines.

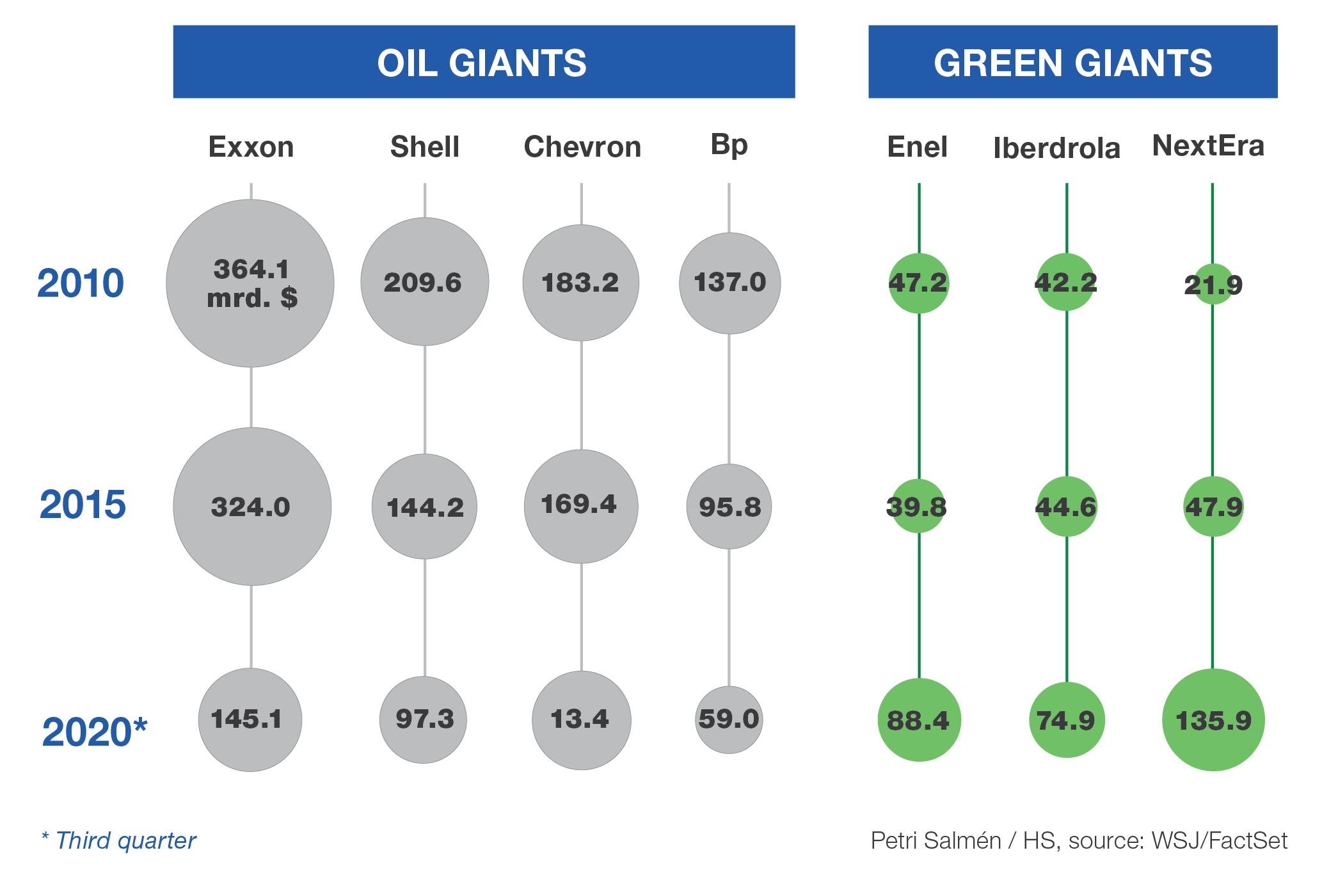

Owners of these gas fields are typically big oil and gas companies who for well over a century have made their profits by exploring and selling oil. Now, these companies are rapidly shifting to cleaner businesses, such as LNG, to reverse their declining revenues.

Below are some interesting numbers showing market capitalizations – basically the value of the company – of some “oil majors” vs “green majors.” They clearly show the declining trajectory of the oil business. As the oil assets are becoming worth less, in part due to the electrification of the auto industry, investors would rather park their money in greener businesses, forcing oil companies to seek new revenues from there. They are now rapidly divesting or writing off oil assets worth tens or even hundreds of billions of dollars, while at the same time, heavily investing in wind and hydrogen infrastructure, along with LNG.

Figure: Market capitalization development of some oil and green energy companies during the last decade (in BUSD)

Besides heavily investing in green technologies, these oil companies have put energy efficiency as one of their top driving factors in all processes and decision-making. This has caused shaft generators to replace conventional gensets, and furthermore, more efficient permanent magnet generators to replace conventional electrically excited synchronous machines. Since LNG tankers often require a relatively large amount of electric power on board, for example, due to hull air lubrication, benefits by using PM solution results in significant fuel savings and lower emissions.

Increasing demand for highly efficient megawatt-class shaft generators has put our marine business back on track, and currently we have around 40 such machines in our production pipeline.

Jussi Puranen